Checking

Checking account

Our high yield checking account allows you to easily deposit and withdraw money for daily transactions. This includes depositing a check you receive, taking out cash with your debit card or setting up direct deposit for your paychecks. The primary purpose of a checking account is to hold your money in a secure place for the short term, so it’s available when you need it to pay your bills and other expenses. You can have your paycheck sent to your checking account (known as direct deposit) and then move a portion your earnings to a savings or investment account where it can grow over time.

- Fast and Secured Transaction.

- Overdraft protection of up to $100

- Low Monthly service fee

- One Free debit card

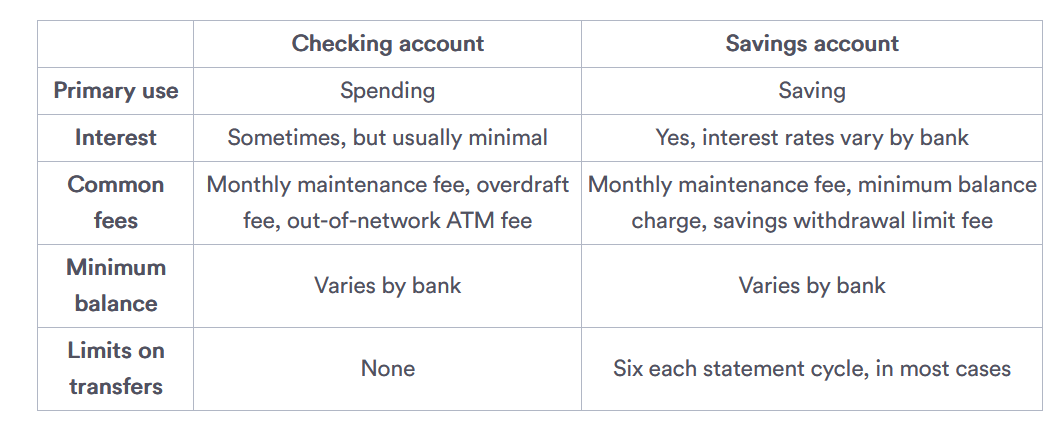

Checking accounts shouldn’t be used for long-term goals, such as saving for a house, since you earn a low interest rate, averaging about .04%. However, some banks may provide a variety of tiers for their checking accounts so there is always the chance to earn slightly more interest if you keep more money in your account. Here are some difference between a Savings and a checking account.

Compare us with others

We have proven to be the best so far. Compare us with other Banking facilities and see the clear winner.

| Service | United Gulf | Other Banks 1 | Other Banks 2 |

|---|---|---|---|

| Overdraft up to $200 | |||

| 5 Tier Support System | |||

| Low Opening Balance | |||

| Smart Notification | |||

| Small Business Support | |||

| Large Business Support | |||

| One Touch UI |